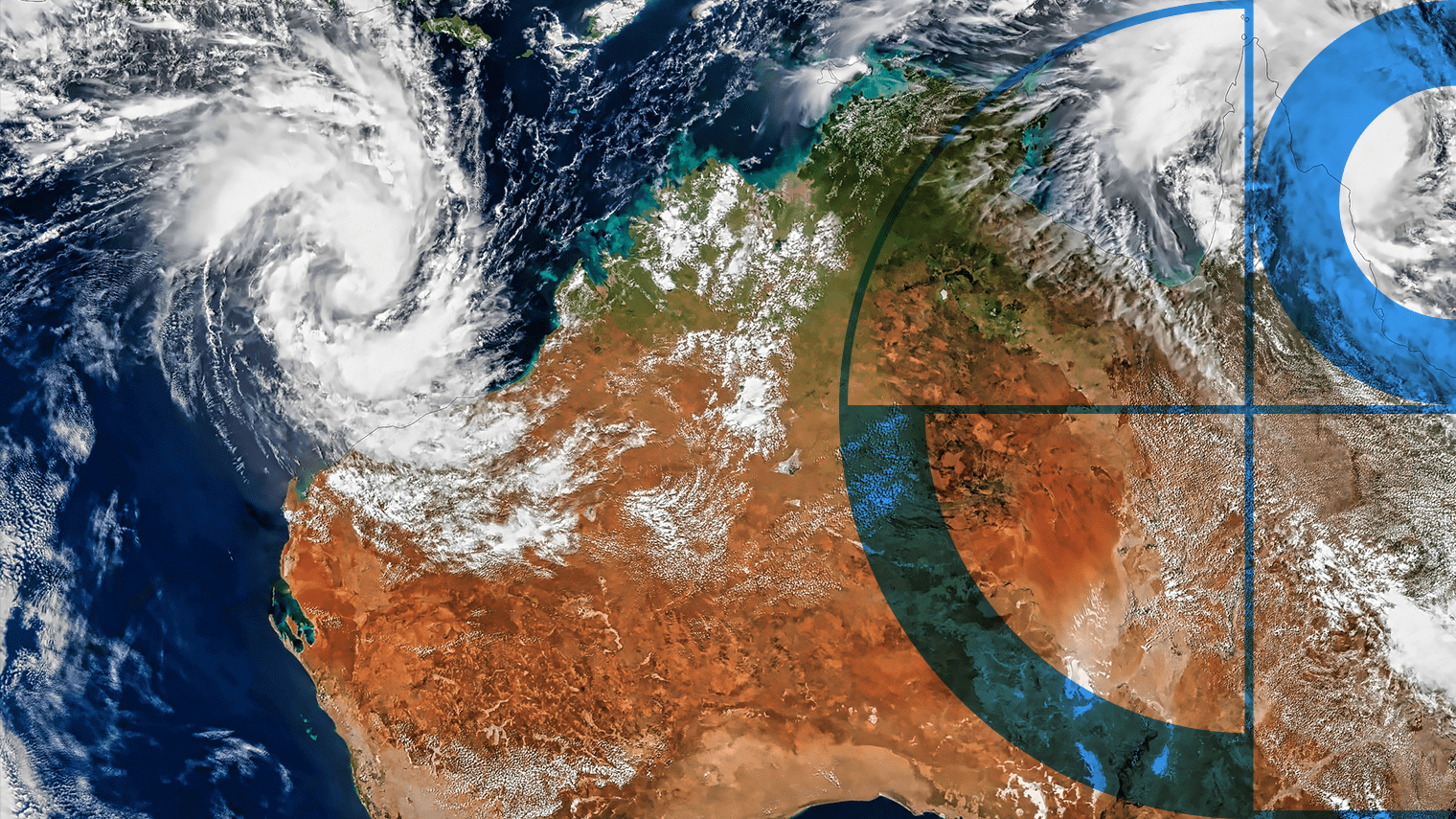

In an era where the impacts of climate change are increasingly evident, understanding its effects on sectors such as household insurance is crucial.

The Australian Prudential Regulation Authority (APRA) embarked on the Insurance Climate Vulnerability Assessment (Insurance CVA), to explore how climate change could affect household (home and contents) insurance affordability in Australia.

The Insurance CVA will assess the potential impact of two climate scenarios on future household insurance affordability for free-standing residential properties, through collaboration with Australia’s top five insurers.

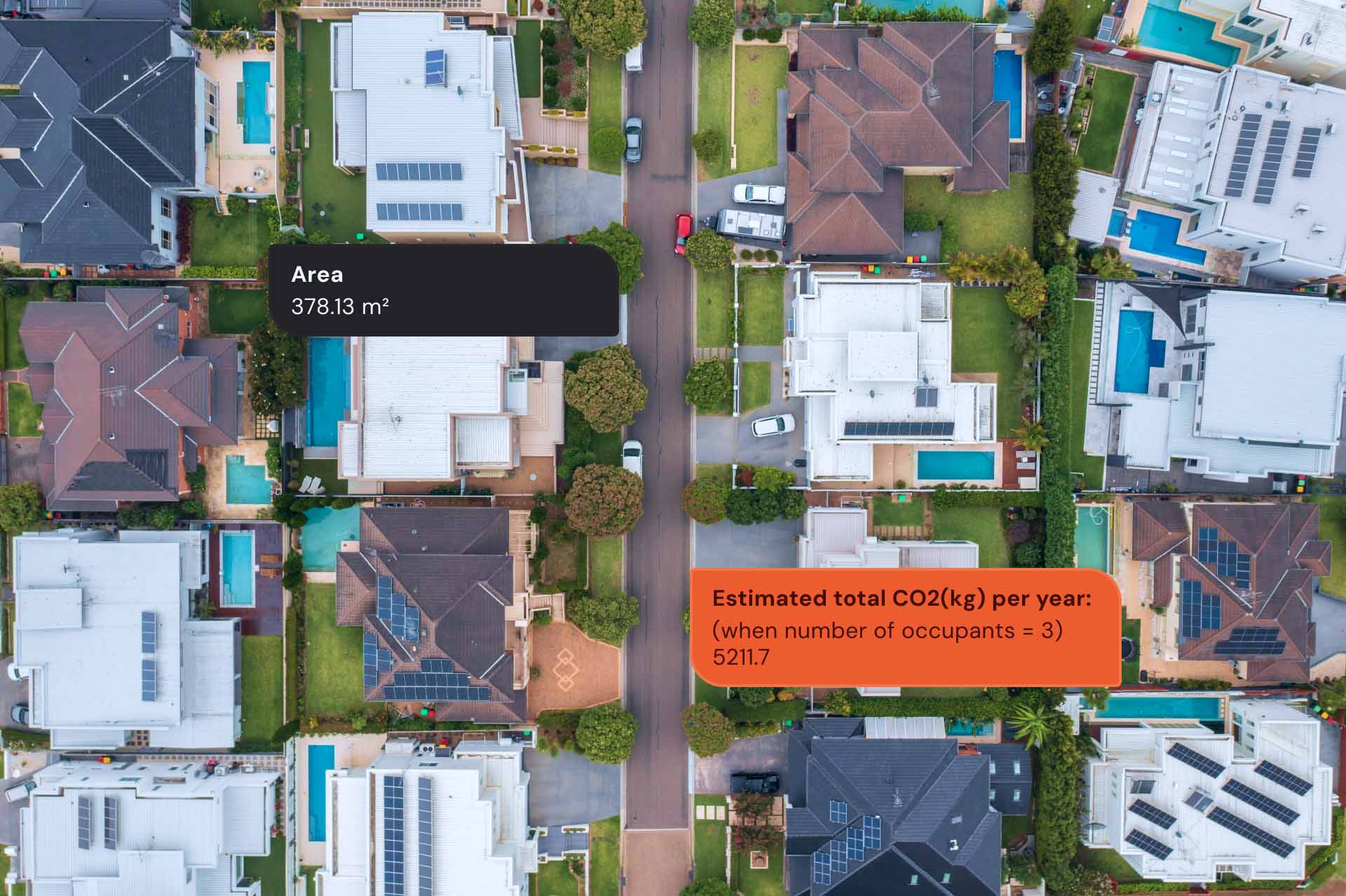

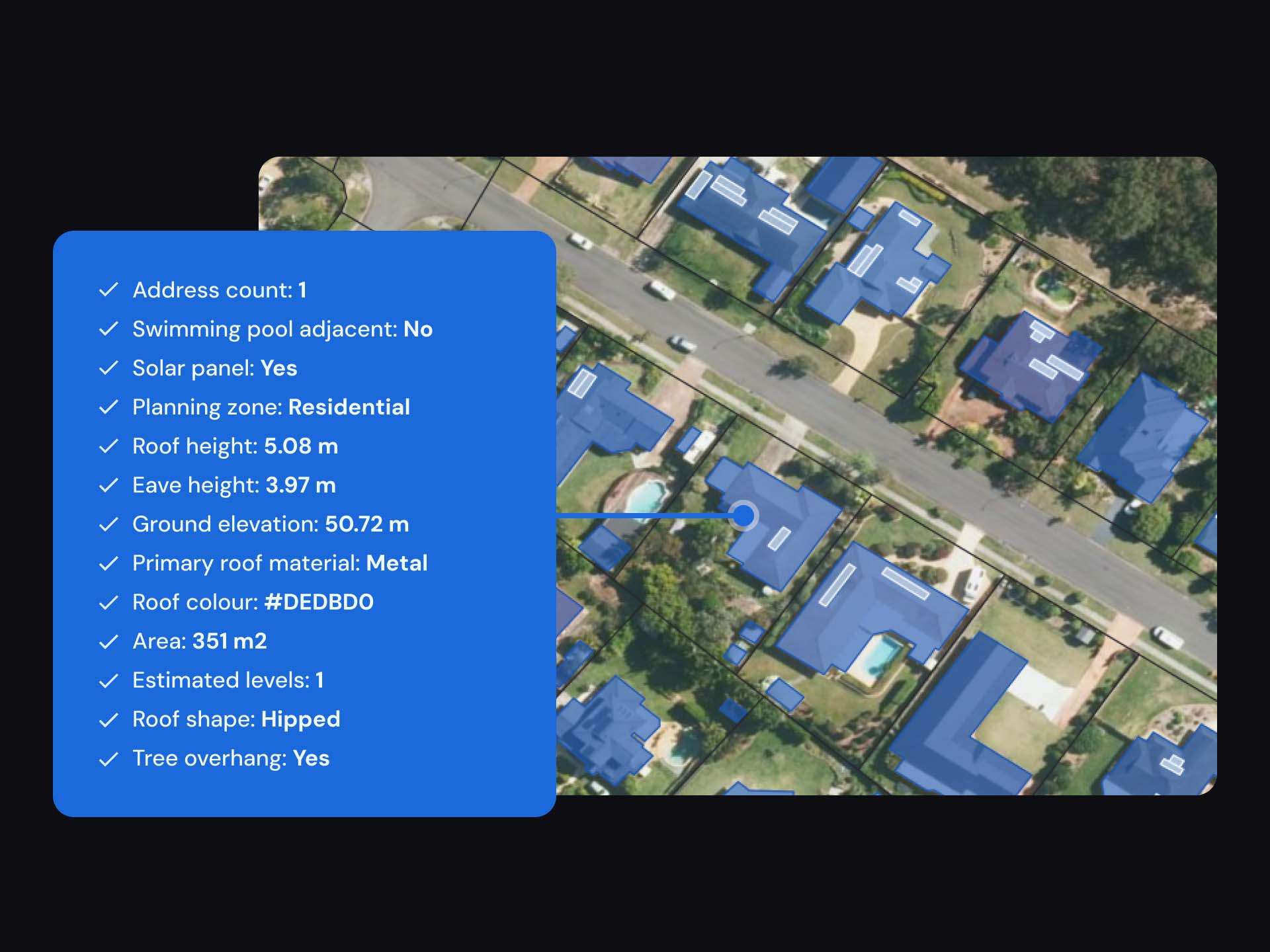

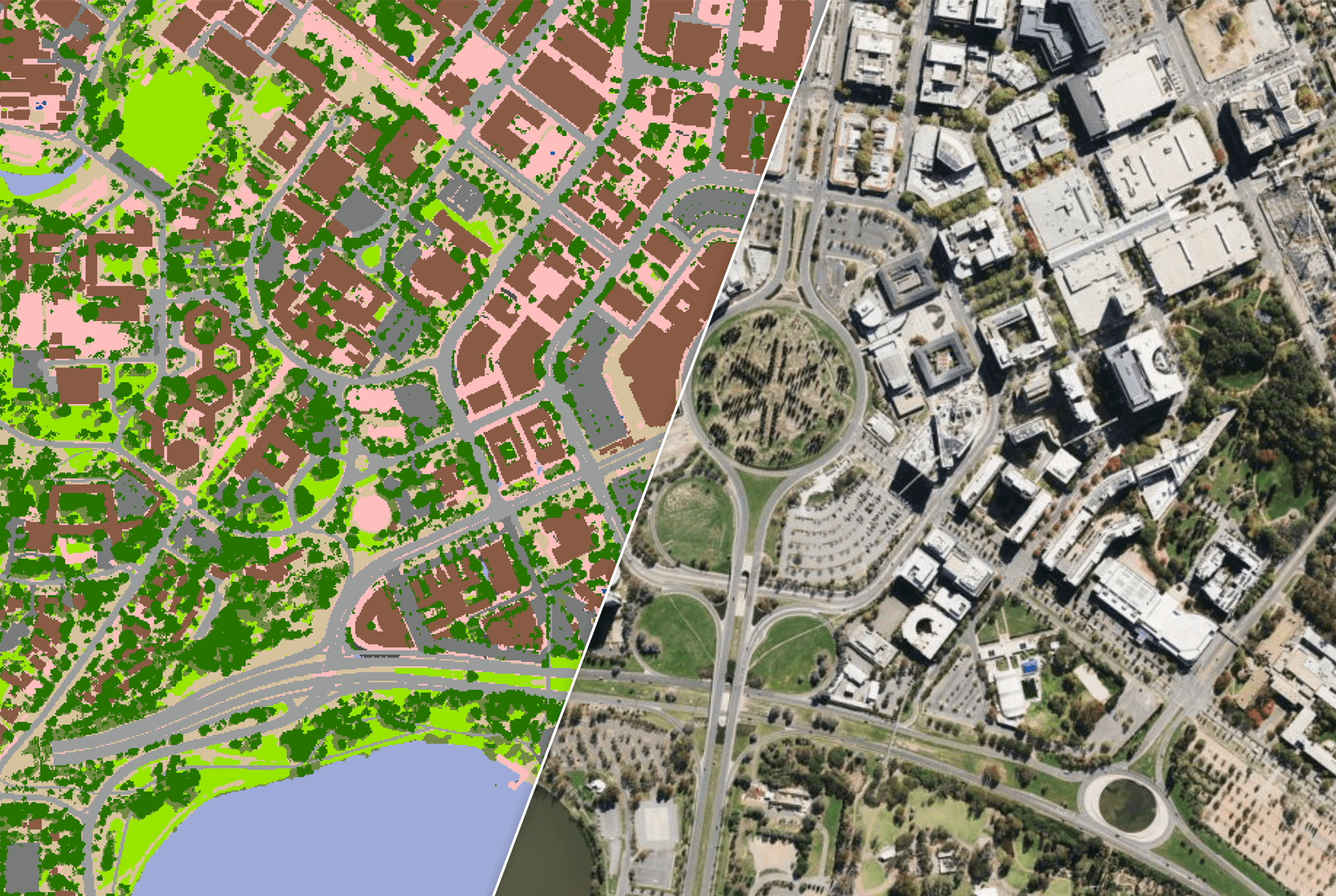

The challenge for Geoscape was multifaceted: identifying relevant residential freestanding properties (typically excluding multistorey strata-titled properties) and providing a robust common dataset for the participating insurers to model insurance premiums under various climate scenarios to 2050.

Geoscape’s Solution

Geoscape played a pivotal role in the project by using its location intelligence expertise to provide tailored data solutions that aligned with APRA’s requirements.

The process involved refining datasets to focus on relevant residential properties, which included freestanding residential properties, which typically excludes multistorey strata scheme properties, and excludes non-residential properties such as commercial buildings.

Geoscape’s solution provided several benefits to the project including increased comparability of results through the use of a common data set, maintaining focus on the project’s core purpose to examine household insurance affordability challenges, and lowering operational costs by selectively removing unnecessary records.

The Insurance CVA findings, supported by Geoscape’s data, will support an improved understanding of potential future household insurance affordability challenges under the two different climate-change scenarios.