Authored by: Dr. Stuart Barclay

Australia’s housing crisis isn’t just about the amount of land available – it’s about whether that land can actually be used to deliver homes. For new developments to succeed, land must be safe, permitted, serviceable, and insurable.

In Part 1 of our Housing Suitability Index series, we explored Everyday Living Quality. Now, we shift focus to a site’s build-readiness: whether a parcel can realistically support new homes. This involves three key indices: Suitability, Vulnerability, and Insurability.

Suitability: Can the Land Be Developed Within Rules and Budgets?

Before construction begins, land must meet basic feasibility requirements. This includes:

• Zoning that permits residential use

• Access to essential services like water, sewerage, electricity, and telecommunications

• Reasonable development costs relative to the land’s value and the target housing market

Residential zoning ensures compliance with use restrictions and design standards, such as building height limits, floor space ratios, and minimum lot sizes. Gaining approval often involves multiple regulators, including local councils, planning authorities, and environmental or heritage agencies.

Infrastructure availability also matters. Modern developments require underground service connections, which are significantly more expensive than overhead alternatives – often five times the cost. If no connections exist, developers face high upfront costs.

Together, these zoning and servicing factors can make or break the viability of a housing project.

Vulnerability: Is the Site Exposed to Natural Hazards?

Climate risks are now central to land-use planning. A buildable parcel must also be safe and likely to remain safe in the future.

Australia faces increasing exposure to extreme weather events, including:

• Floods

• Bushfires

• Coastal erosion

• Heatwaves

• Storm surges

Housing location helps assess:

• Current hazards: Avoiding development in known floodplains, bushfire-prone areas, or erosion zones.

• Future hazards: Anticipating how climate change may shift risk zones – such as rising sea levels or intensifying fire weather.

Best-practice planning incorporates adaptive tools, such as:

• Dynamic zoning overlays

• Trigger-based policy changes (e.g. retreat corridors)

• Resilient building standards (e.g. elevated floors, fire-resistant design)

By embedding resilience early, developments can avoid future retrofit costs – or worse, population displacement.

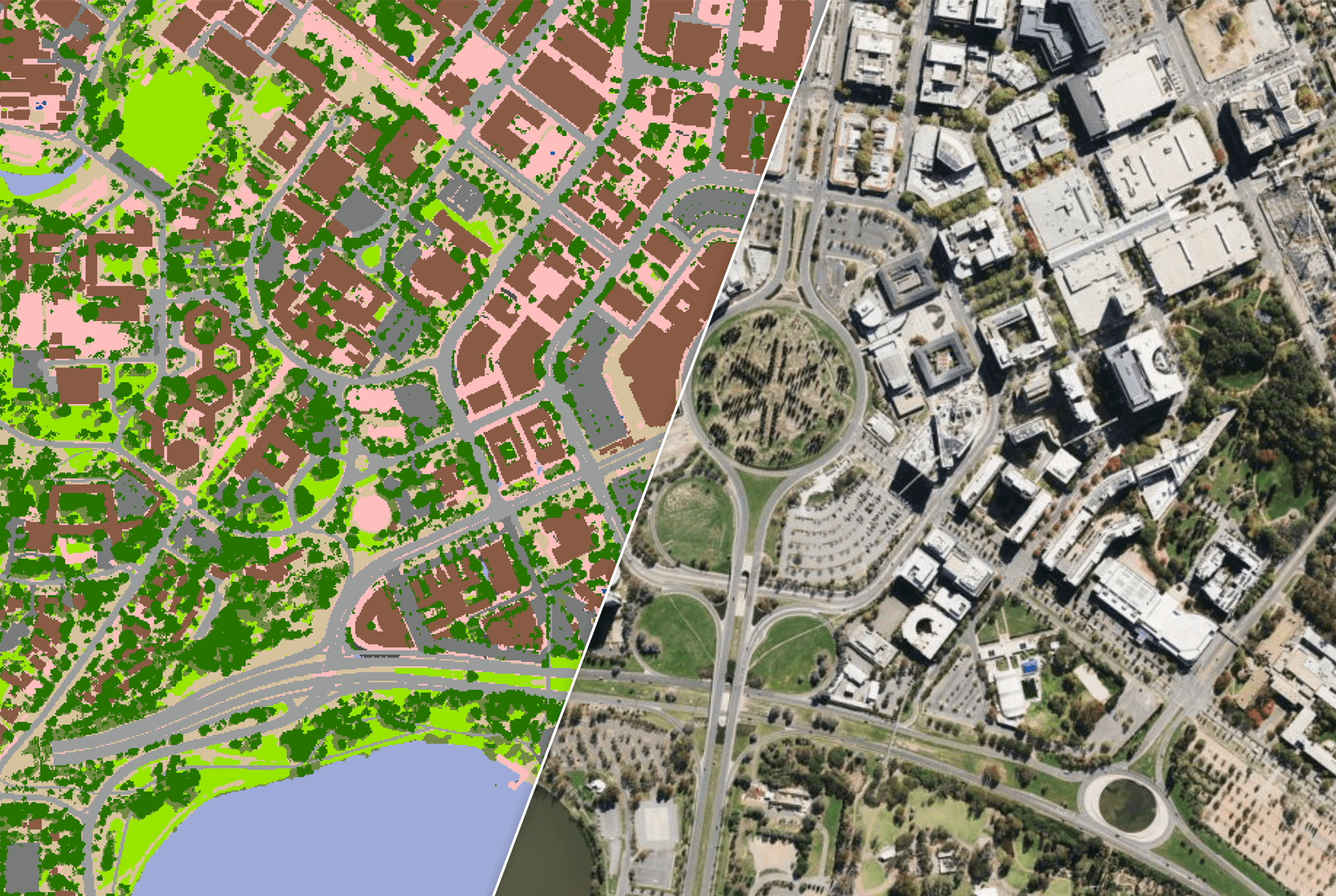

An aerial view of vacant residential land. Source: Shutterstock

Insurability: Can Future Residents Secure Affordable Insurance?

A property’s financial viability doesn’t stop at construction. If it cannot be insured at a reasonable cost, it may be unsellable or unaffordable for residents.

In many parts of Australia, insurance premiums are rising due to increased weather-related claims. Some regions face the risk of becoming effectively uninsurable.

According to the Insurance Council of Australia, insured losses from declared catastrophes have tripled as a share of GDP over the past three decades: from 0.2% (1995–2000) to 0.7% (2019–2024). These rising costs are passed on to consumers.

For lower-income households, this creates a dangerous trade-off: reduce coverage (“underinsurance”) or forego insurance entirely. This leaves communities more vulnerable to financial ruin after disasters – especially in high-risk zones where insurance costs are already prohibitive.

Effective development planning requires consideration of future insurance accessibility, especially as climate risks intensify.

How Location Intelligence Helps

Location intelligence integrates regulatory, environmental, infrastructure and financial data into a cohesive picture of land feasibility. It enables planners and developers to:

• Identify parcels zoned for development and already serviced

• Overlay hazard maps to assess environmental risks

• Flag locations where insurance availability may be limited or costly

This early insight reduces the risk of stalled developments, stranded assets, or housing located in danger zones.

Why It Matters

Land that appears viable at first glance may fail one or more of these critical checks. Ignoring zoning restrictions, hazard exposure or insurance constraints can lead to:

• Unexpected development costs

• Delays or refusals in approvals

• Long-term affordability or safety issues for residents

Using geospatial data, we can screen land for build-readiness, before major investments are made, so homes are delivered in places people can afford to live, safely and securely.

Coming Up Next

In Part 3, we’ll turn to two future-focused indices:

Sustainability and Accessibility.

These show whether a site can support resilient, connected communities – not just today, but into the decades ahead.