Authored by: Matthew Longmore

In September 2024, the Australian Accounting Standards Board (AASB) introduced the Australian Sustainability Reporting Standards (ASRS), which include:

AASB S1: General Requirements for Disclosure of Sustainability-related Financial Information (Voluntary)

AASB S2: Climate-related Disclosures (Mandatory)

AASB S2

AASB S2 requires companies to disclose climate-related risks and opportunities that may affect their cash flow, access to finance, or cost of capital.

It focuses on four key themes:

Governance: How the company oversees and manages climate-related risks and opportunities.

Strategy: How climate risks and opportunities affect the business model and strategy.

Risk Management: How climate risks and opportunities are identified, prioritised, and monitored.

Metrics and Targets: Which metrics and targets used to assess and manage relevant climate-related risks and opportunities, including Scope 1, Scope 2, (energy related) and Scope 3 (value-chain or supply chain) emissions in alignment to the Greenhouse Gas protocol.

AASB S2 requires companies to assess climate resilience through scenario analysis, evaluating risks under different future scenarios. This helps inform stakeholders about potential impacts on the company’s strategy, key uncertainties, and its ability to adapt to climate change over time.

Mandatory reporting under AASB S2 starts from annual reporting periods beginning on or after 1 January 2025. Companies must include climate-related disclosures in their annual financial reports, aligned with the Corporations Act 2001.

How Companies Are Responding

To explore how businesses are tackling these challenges, we spoke with Dathan Birrell, Chief Sustainability Officer, and Ash Ranu, Chief Risk Officer at Sustain 2050

Sustain 2050’s work with various organisations reveals a pattern: large companies tend to have well-developed internal systems or external partnerships to manage reporting, whereas smaller firms are still building their capabilities.

To adapt, businesses are assessing data gaps and building systems that balance immediate compliance with long-term accuracy.

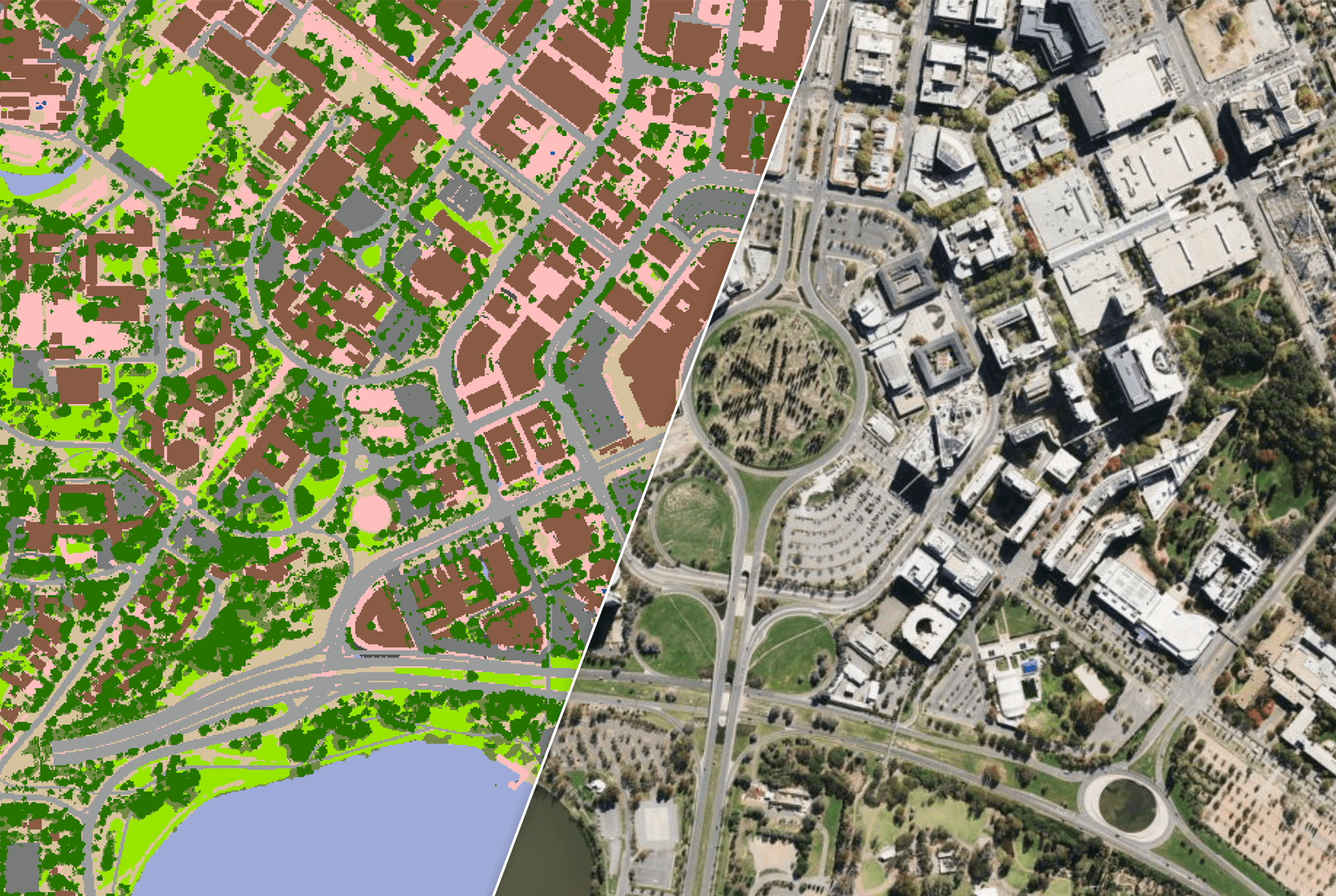

For instance, companies can use third-party location services, such as those provided by Geoscape Australia, to overcome the lack of their own data and accurately map assets down to specific addresses, properties, and buildings.

Sustain 2050 has worked with clients to combine this location data with climate risk datasets to get a granular understanding of climate risk at the discrete property/asset level. Integrating geospatial and internal company datasets helps identify climate risks and opportunities, leading to smarter business decisions.

But common challenges remain for many businesses.

Key Challenges in Climate Reporting

Regulatory Uncertainty: Changes in political and regulatory environments can create confusion around compliance. Companies should develop systems flexible enough to adapt to evolving rules.

Data Quality: Accurate reporting relies on consistent data, but industries with large portfolios, like real estate and finance, struggle with fragmented systems.

Resource Constraints: Smaller companies often lack expertise and may rely on consultants to build compliance processes.

Integrating Climate Risk Assessments: Incorporating climate factors into risk management processes can be difficult, particularly with long-term planning or scenario analysis.

Despite these challenges, forward-thinking companies are making strides to position themselves for success.

Trends Shaping the Future of Climate Reporting

As companies adapt to the new climate reporting framework, several key trends are emerging:

Higher Stakeholder Expectations: Investors, customers, and regulators are demanding more detailed and transparent climate disclosures. Companies that provide high-quality data will be better positioned to maintain trust and adapt to market changes.

Early Preparation: Starting early on data collection, aggregation and system improvements helps companies plan and importantly, engage with suppliers, partners and customers to align with overall business strategy.

These trends highlight the need for proactive planning.

Companies that act early and leverage improvements to data accuracy gain more than compliance. They avoid risks, build trust, can act on opportunities, and stay ahead of competitors.